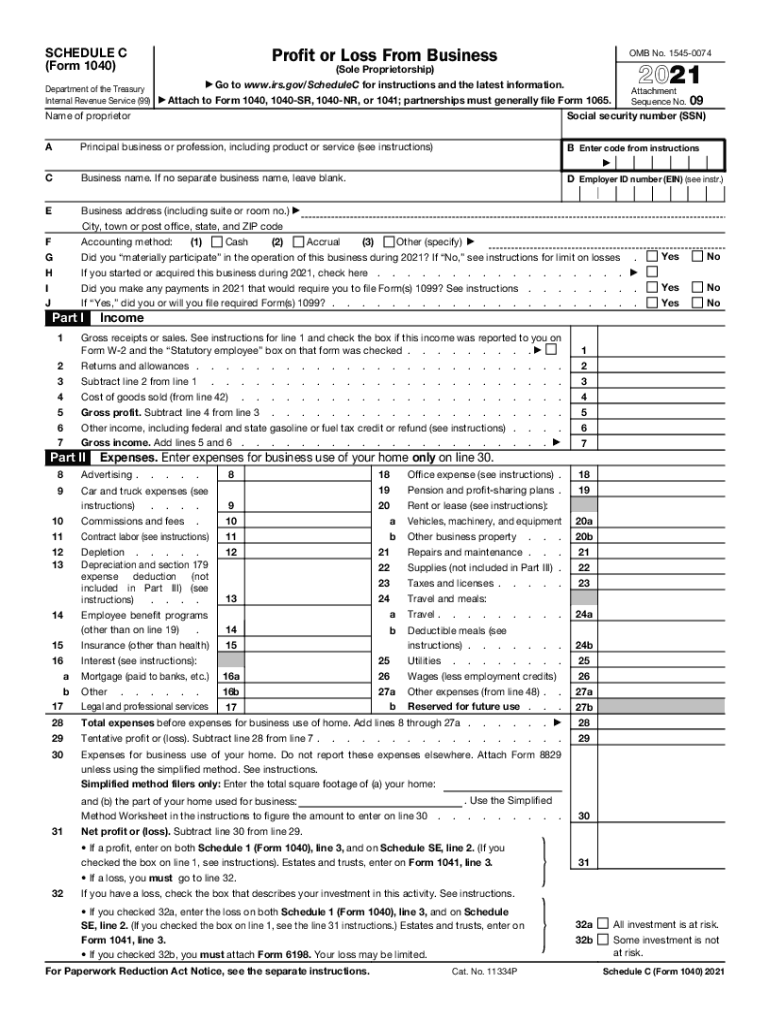

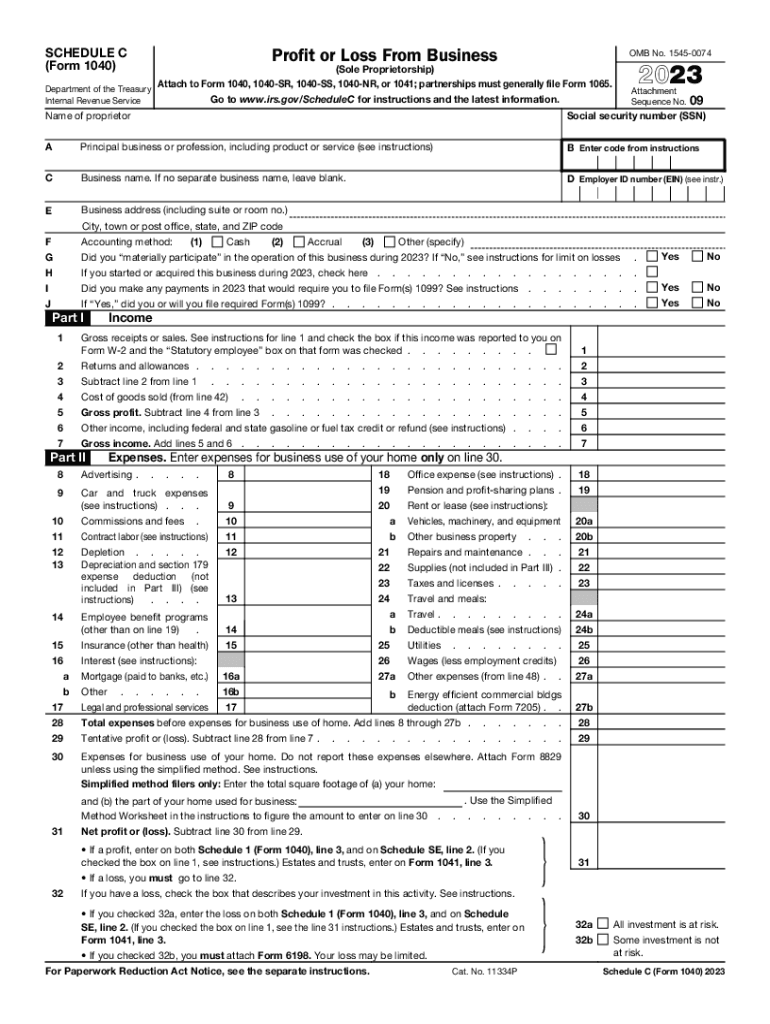

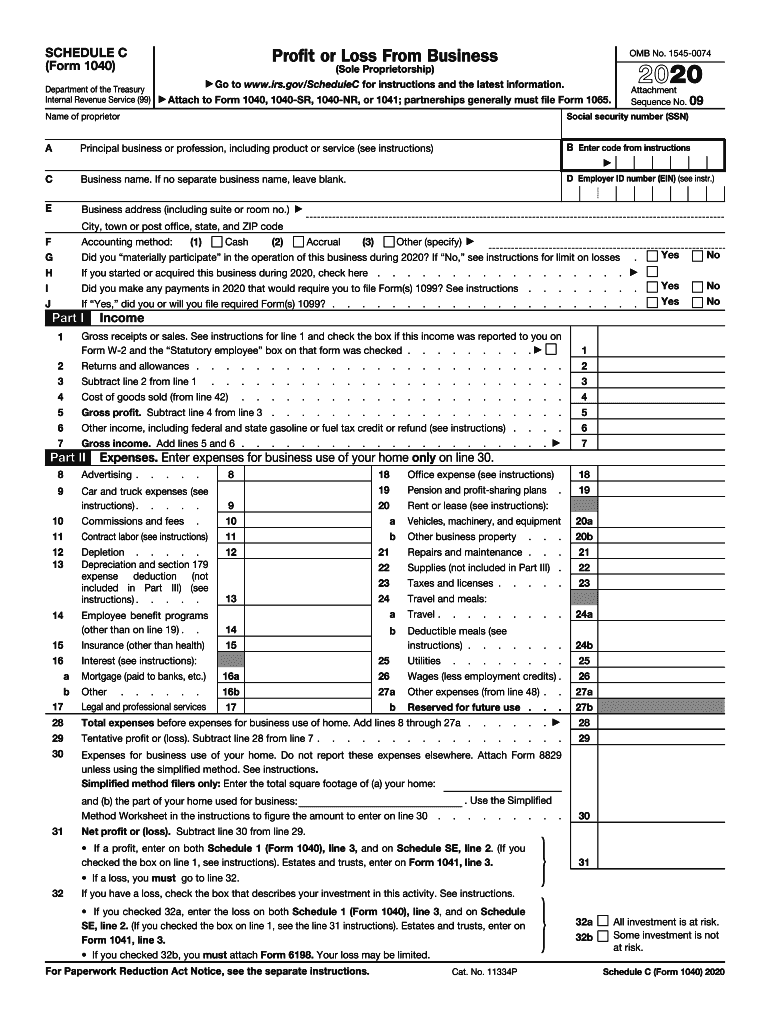

2024 Schedule C Form 1040 – Attach the Schedule C to your regular form 1040. Submit the forms to the IRS. There is no need to indicate on your Schedule C that you are closing your sole proprietorship. Tips Do not submit a . You report commercial sales tax to the IRS on Schedule C, a supplemental sheet of the 1040 group of forms. Form 1040, Schedule C Use Schedule C to report all financial activity from your business. .

2024 Schedule C Form 1040

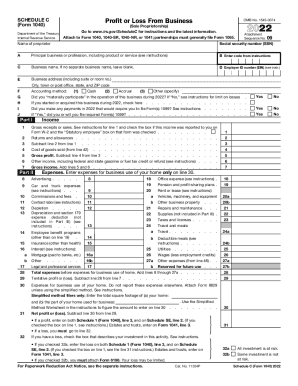

Source : www.kxan.com2018 2024 Form IRS 1040 Schedule C EZ Fill Online, Printable

Source : irs-schedule-c-ez.pdffiller.comWhat Is Schedule C (IRS Form 1040) & Who Has to File? NerdWallet

Source : www.nerdwallet.comIRS Schedule C (1040 form) | pdfFiller

Source : www.pdffiller.comSchedule C (1040 form) | signNow

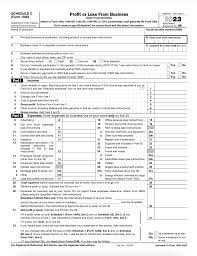

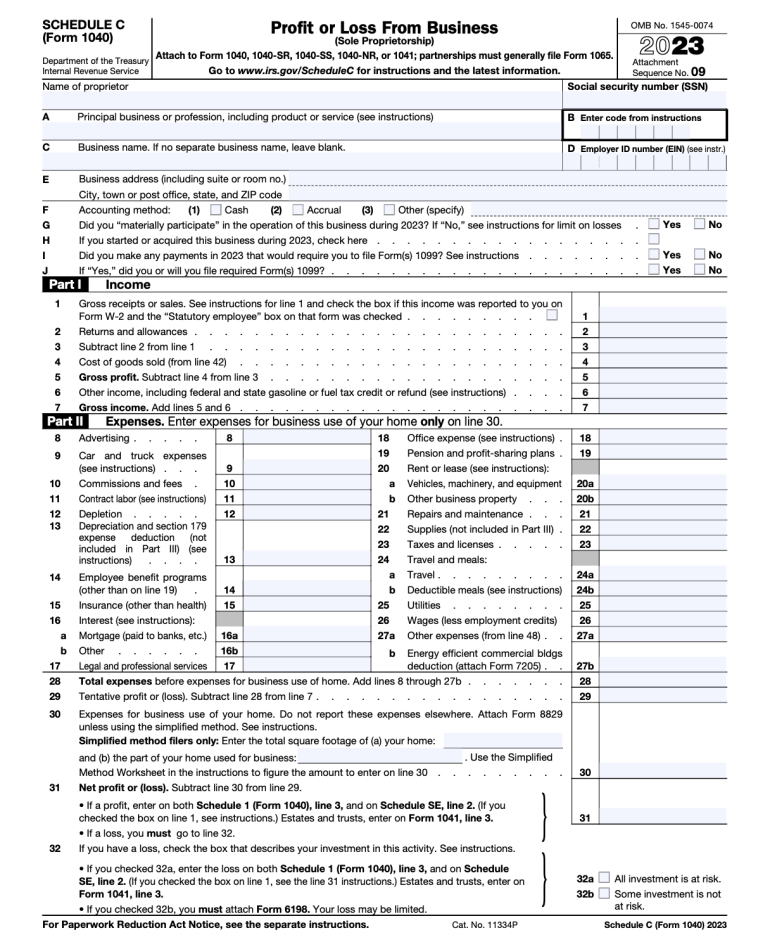

2023 Form IRS 1040 Schedule C Fill Online, Printable, Fillable

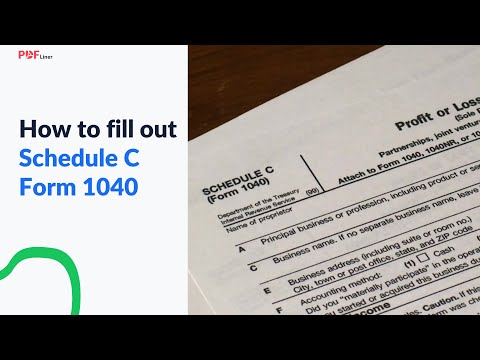

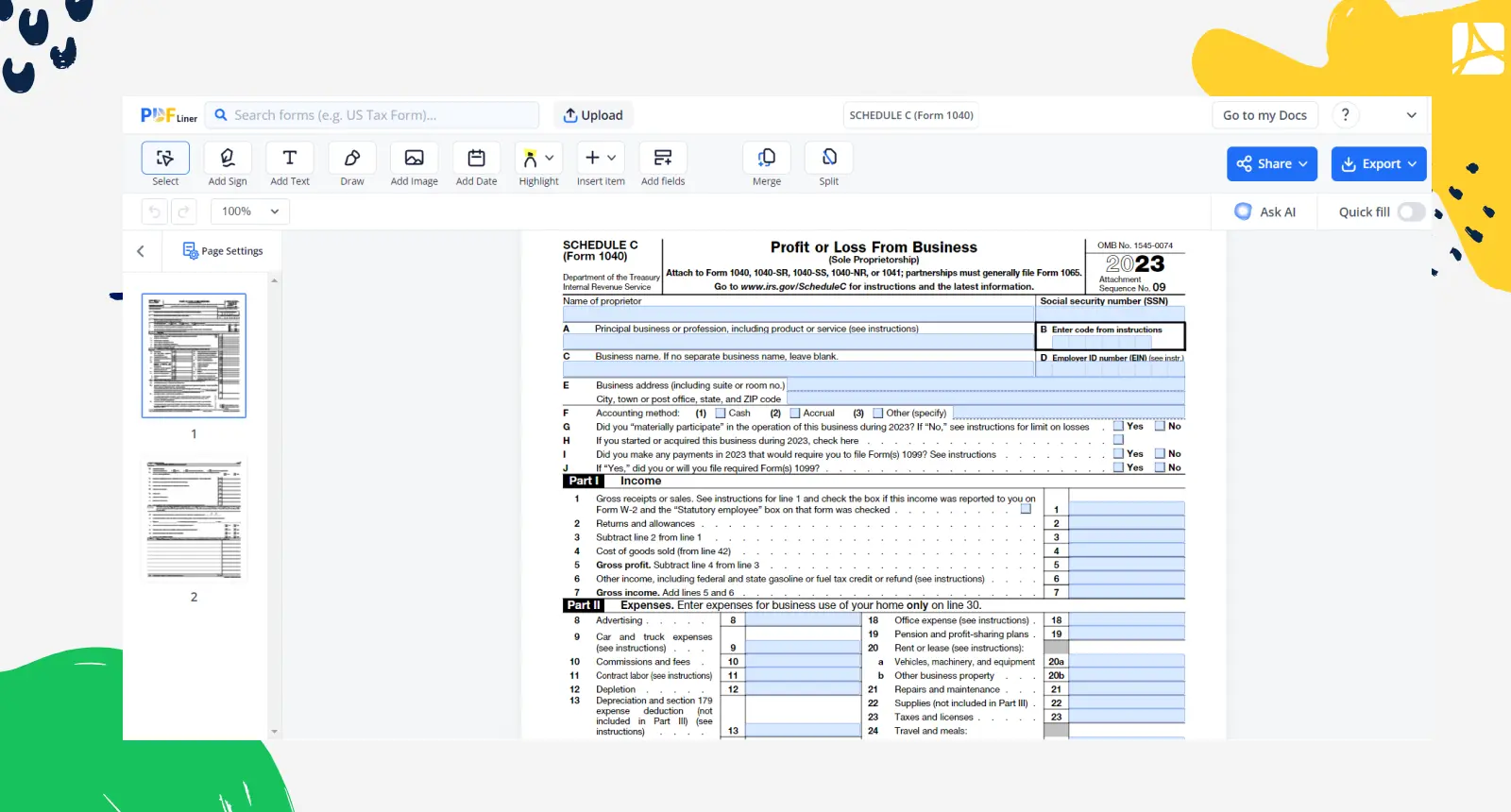

Source : 1040-schedule-c.pdffiller.comTaxes Schedule C Form 1040 (2023 2024) | PDFliner

Source : pdfliner.com2023 Form IRS 1040 Schedule C Fill Online, Printable, Fillable

Source : 1040-schedule-c.pdffiller.comTaxes Schedule C Form 1040 (2023 2024) | PDFliner

Source : pdfliner.comSchedule c form: Fill out & sign online | DocHub

Source : www.dochub.com2024 Schedule C Form 1040 Harbor Financial Announces IRS Tax Form 1040 Schedule C : Travel expenses can be deducted on Schedule C (Form 1040), Profit or Loss From Business (Sole Proprietorship), or Schedule F (Form 1040), Profit or Loss From Farming, if you’re self-employed or a . Rather than claiming your winnings as “other income” on your Form 1040, you will file Schedule C as a self-employed individual. This is an important distinction, because you can deduct your other .

]]>